SUMMARY: Healthcare CFOs carry one of the toughest responsibilities in the industry: maintaining financial stability while managing the unpredictable realities of clinical demand, provider availability, and external labor markets.

Here’s the truth most CFOs already know and most organizations avoid saying out loud:

- You don’t need more dashboards.

- You don’t need more reports.

- And you don’t need another new system to log into.

You need a clearer understanding of how staffing decisions are made, how they drift, and how financial impact emerges long before it shows up in the month-end close.

This guide breaks down the core drivers of workforce spend, what CFOs typically can’t see soon enough, and how to get control of staffing costs without adding another tool to the tech stack.

1. Most Workforce Spend Problems Start Long Before Finance Sees Them

Finance is almost always downstream of the operational reality.

By the time labor variance appears:

- A provider’s availability didn’t get updated

- A credentialing clearance wasn’t communicated

- A scheduler filled a gap with an agency before internal options surfaced

- Workload imbalance created burnout pressure

- A new hire was ready to work but not deployed

- A site had increased demand without aligned staffing

- A “temporary” agency usage pattern became normal

None of these events look financial in the moment. They become financial when the invoice arrives. CFOs don’t need to know every operational detail but they do need to see the early indicators that forecast spend.

2. Internal Capacity Is the Single Most Misunderstood Driver of Overspend

Every organization assumes it’s maximizing internal resources. Few actually are.

Why? Because internal capacity is often hidden behind:

- Outdated availability

- Unclear eligibility

- Slow credentialing-to-scheduling handoffs

- Missing updates about cross-site readiness

- New providers who aren’t added to templates

- Underutilized clinicians who don’t trigger alarms

When internal supply is unclear, external labor fills the void. The result: what looks like “necessary” agency spend is often preventable.

For a CFO, the question isn’t: “Why did we use external coverage?” The question is: “Did we have internal capacity we couldn’t see?”

Most don’t have a way to answer that with certainty.

3. Workload Imbalance Creates Hidden Financial Pressure

Workload imbalance doesn’t show up in the general ledger. It shows up in:

- Burnout

- Overtime

- Avoidable PTO usage

- Premium shifts

- Uneven clinic volume

- Rising locum reliance

- Turnover risk

Almost every CFO has experienced the “ripple effect” where:

A few overextended providers → higher burnout → more gaps → more external labor → more overspend.

Workload imbalance is an early warning signal for financial instability but most organizations track it poorly or not at all. When providers aren't scheduled intentionally, the budget pays for it.

4. Agencies Become the Default When Internal Processes Lag

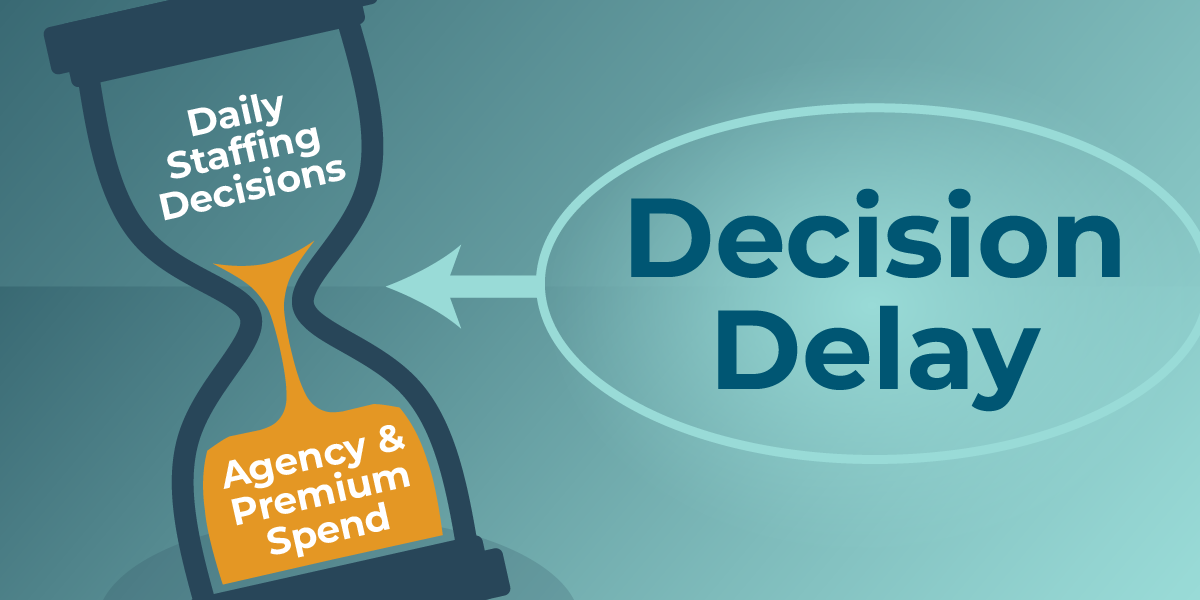

Most agency overspend is not the result of poor decision-making. It’s the result of lag.

Common examples:

- Internal availability isn’t updated quickly enough

- Eligibility isn’t communicated in time for schedulers to act

- Credentialing delays aren’t flagged until the last minute

- Scheduling runs on outdated templates

- Clinical leaders escalate staffing gaps reactively

In fast-moving operations, the group with the clearest workflows wins, and that’s often the agency. For CFOs, the issue isn’t anti-agency sentiment. It’s understanding why the organization is defaulting to external labor more frequently than expected.

5. Budget Expectations Drift Without a Shared Operational Model

Finance and operations rarely share the same real-time staffing picture.

Finance sees:

- Planned spend

- Forecasted volume

- Budget models

- Contract expectations

Operations sees:

- Today’s gaps

- Today’s burnout risk

- Today’s eligibility

- Today’s onsite needs

- Today’s provider availability

When these two views don’t align, budget drift follows. The solution is not tighter guardrails. It’s shared visibility and shared assumptions. Budgets aren’t just numbers. They’re operational behaviors expressed financially.

6. What CFOs Actually Need to See (And When)

A CFO doesn’t need another interface. They need a core set of insights delivered consistently:

- Internal vs. external coverage in real time: Was external spend truly necessary?

- Providers who are underutilized: Which internal resources could be redeployed?

- Eligibility and readiness: Which providers are cleared but not working?

- Workload balance across teams: Who is overextended? Who has room?

- Onboarding-to-scheduling timelines: Are new hires deployed quickly or idling?

- Cost impact of daily staffing decisions: Which shifts carry unnecessary premium?

- Agency usage patterns: Are agencies filling gaps or filling process failures?

None of these require a new tool to understand. They require unity in how staffing data is captured and shared.

7. The CFO's Levers for Better Workforce Economics

CFOs drive financial improvement not by micromanaging staffing, but by asking better questions earlier.

Key levers include:

- Connecting finance and operations weekly instead of monthly

- Asking for visibility into readiness and eligibility (not just schedules)

- Reviewing internal vs. external mix trends in shorter cycles

- Monitoring workload imbalance as a financial risk

- Ensuring new hires are deployed quickly

- Supporting scheduling as a strategic function

- Championing centralized visibility across staffing data

Better decisions don’t come from more tools. They come from shared truth.

How Kimedics Helps CFOs Close the Visibility Gap

Kimedics gives finance leaders a clear, real-time view of workforce patterns that directly influence cost:

- Internal vs external usage

- Provider readiness and deployment

- Workload balance

- Agency reliance

- Scheduling decisions

- Cost-per-shift impact

- Onboarding progress

- Utilization drift

CFOs don’t have to become staffing experts. They simply need access to the same operational truth as the teams making daily coverage decisions. Kimedics makes that alignment possible.

Want clearer visibility into what’s really driving your workforce spend?

Request a Demo

Learn more about Kimedics

Kimedics is a provider utilization management platform. We help healthcare organizations gain visibility across internal and external staffing to reduce complexity and improve financial performance. For more information, book a demo or email kimedics@kimedics.com