The Workforce Misdirection Series: How Healthcare Teams Lose Their Way and How to Get Back on Course (6 of 6)

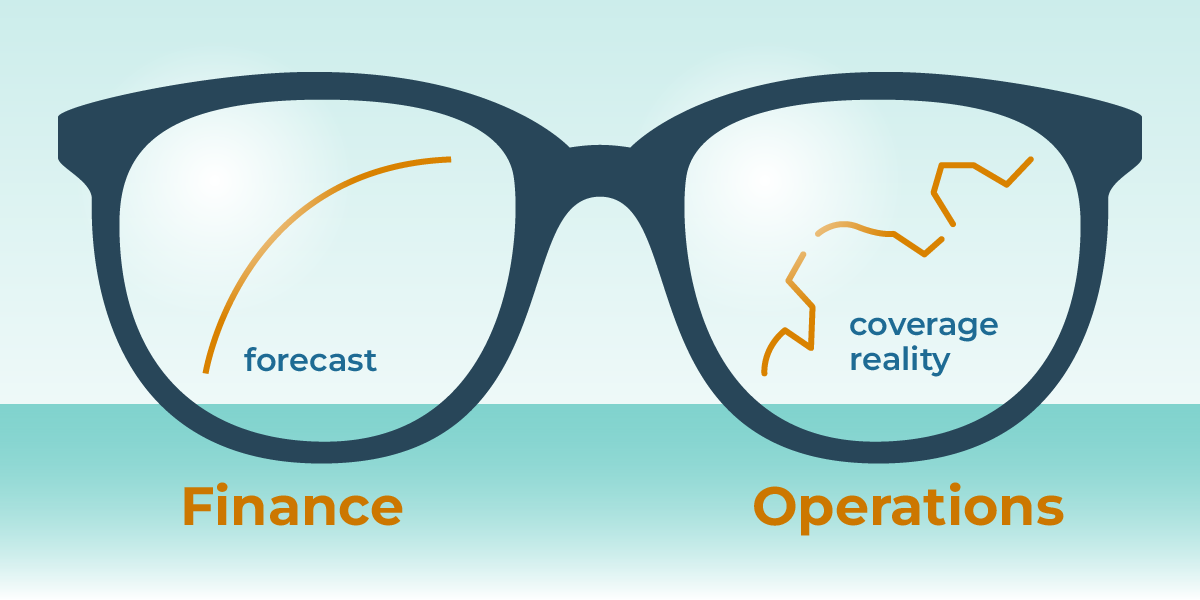

SUMMARY: In most healthcare organizations, finance and operations work toward the same goals: predictable costs, stable coverage, and sustainable staffing models. But in practice, they often operate from two different realities, especially when it comes to staffing budgets. Finance is guided by planned spend. Operations is guided by actual coverage needs. And somewhere between the spreadsheets, schedules, agencies, and fragmented systems, the two pictures drift apart.

This gap doesn’t appear as a single dramatic moment. It shows up in small disconnects that accumulate over time until leaders feel like they’re “missing the mark” even when they’re doing everything right.

This post explains why finance and operations often see different staffing realities and how organizations can finally align strategy, planning, and execution.

1. Finance Plans by the Numbers. Operations Plans by the Day.

Finance teams work from structured models:

- Contracted FTEs

- Expected internal vs. external mix

- Budgeted premium spend

- Forecasted utilization

- Historical cost patterns

- Projections tied to service line volume

Operations teams work from real-time constraints:

- Who is available

- Who is eligible

- Who is burned out

- Who is calling out

- Who is onboarding

- Who can flex

- Which gaps must be filled today

Both are correct but they’re not connected. Finance sees cost exceptions as something to correct. Operations sees cost exceptions as something to survive.

2. Small Workflow Gaps Create Big Budget Variance

Most variance doesn’t come from catastrophic failures. It comes from drift:

- A provider’s availability wasn't updated

- Credentialing cleared someone, but scheduling didn’t see it

- A shift was sent to an agency before internal options were checked

- A clinician was eligible at one site but not updated in the system

- A new provider finished onboarding but wasn’t added to templates

Each disconnect is small. The financial impact is not. These workflow slips appear operational but they land on the budget.

3. Internal Capacity Is Misjudged, So External Spend Fills the Gaps

Finance assumes internal coverage will be maximized before external labor is used. But operations cannot maximize internal coverage if they can’t see internal coverage. When internal availability, eligibility, readiness, or utilization is incomplete or scattered, gaps appear larger than they really are. The predictable result:

- More external coverage

- Higher premium spend

- Agency reliance that feels “necessary”

- Budgets that drift out of range

Finance believes external spend should be the exception. Operations sees it as the reality required to keep care running. Both are acting logically based on the information they have.

4. Leaders Don’t Share a Single Source of Truth — They Share Frustration

The expectations gap widens when each team sees a different version of staffing reality.

Finance sees:

- Higher-than-expected agency invoices

- Payroll variance

- Costs increasing despite “stable volume”

- Budgets that don’t align with the plan

Operations sees:

- Unclear availability

- Bottlenecks in credentialing

- Incomplete scheduling data

- Last-minute coverage pressure

- Providers who are willing to work but invisible in workflows

Because the two groups rely on different systems, reports, and communication channels, they navigate with mismatched visibility. Neither sees the whole picture. Each assumes the other is missing something obvious.

5. Budget Overruns Are Often Rooted in Data Fragmentation — Not Mismanagement

Most budget variance is caused by information misalignment, not poor decision-making.

Common examples:

- Finance doesn’t know that a provider wasn’t eligible yet

- Operations doesn’t see the financial impact of agency shifts

- Clinical leadership isn’t aware that coverage decisions raise spend

- Scheduling doesn’t know when internal capacity becomes available

- Agencies become the fastest option because internal workflows lag

When data is fragmented, cost overruns feel inevitable, because they are.

6. Alignment Becomes Possible Only When Everyone Sees the Same Picture

Organizations that close the expectations gap don’t hold more meetings. They connect the data. They bring together:

- Internal capacity

- External use

- Readiness

- Eligibility

- Utilization

- Agency performance

- Cost impact

- Scheduling decisions

When everyone sees the same staffing reality, three things change immediately:

A. Finance forecasts with accuracy, not assumptions

- Less variance, fewer surprises.

B. Operations plans with clarity, not fire drills

- Better use of internal resources.

C. Clinical leadership gains visibility into how staffing affects care and cost

- Shared accountability becomes possible. With connected data, the debate shifts from “Why are we missing budget?” to “How do we deploy our workforce better?” That’s alignment.

How Kimedics Helps

Kimedics helps organizations close the expectations gap by giving finance, operations, and clinical leadership the same real-time staffing picture. With Kimedics, teams can:

- See internal and external coverage in one place

- Connect scheduling, spend, and readiness

- Identify where external labor is filling preventable gaps

- Forecast staffing needs with real capacity data

- Align budgeting with actual operational patterns

- Reduce variance before it hits the books

When everyone works from the same source of truth, budgets become predictable — and staffing becomes strategic.

Ready to close the gap between your staffing plan and your actual spend?

Request a Demo

Learn more about Kimedics

Kimedics is a provider utilization management solution. We help healthcare organizations reduce scheduling complexity. For more information, book a demo or email kimedics@kimedics.com