SUMMARY: Many healthcare organizations believe they rely on locums because they have no choice. The story often sounds the same. Demand is unpredictable. Internal capacity is inconsistent. Scheduling gaps appear without warning. Teams do what they must to keep coverage intact. Those factors play a role. But they are not the main reason locum costs spiral.

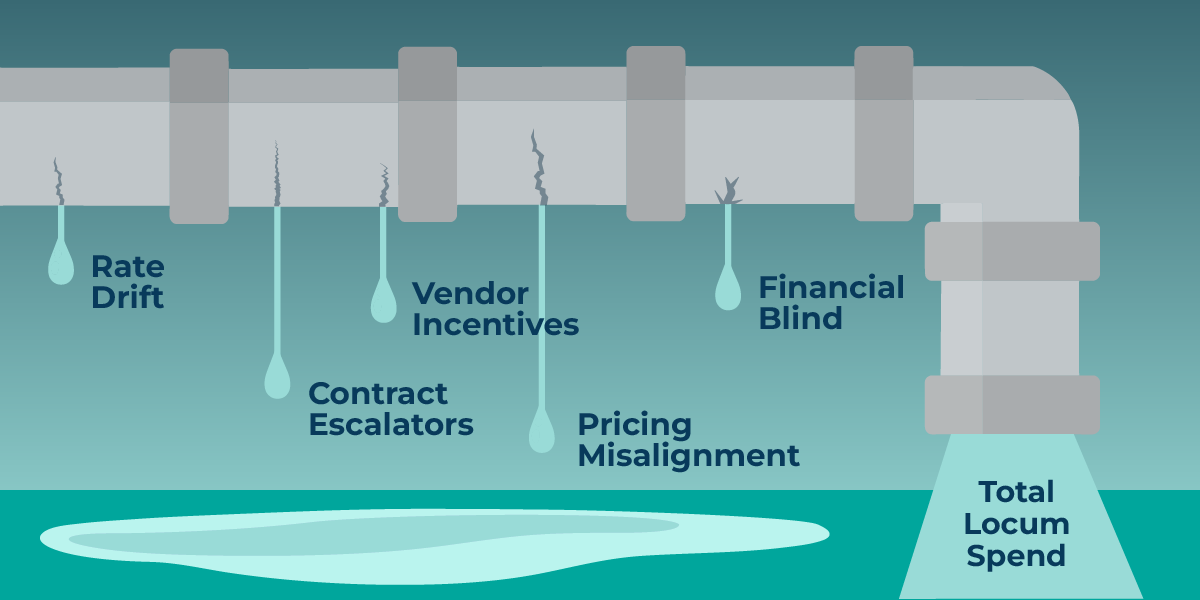

The real driver of locums overspend is financial structure. Most organizations make decisions inside a system of incentives, pricing models, and market dynamics that push costs up in ways leaders often do not see. The economics behind locum usage are complex. They also create avoidable waste when teams do not have clear visibility into how the money moves.

Locum overspend is not a staffing failure. It is a financial one. And leaders who understand the mechanics can regain control faster than they expect. This post breaks down why locums costs escalate and what healthcare organizations can do to break the cycle.

1. Market Dynamics Create Upward Pressure on Rates

The locum marketplace favors sellers. Agencies negotiate in a competitive environment where:

- demand outpaces supply in key specialties

- seasonal spikes create pricing surges

- short-notice shifts command premium multipliers

- rural and multisite coverage creates added fee layers

Organizations often assume high rates are unavoidable. The truth is that rate variability is significant. Without benchmarking, teams do not know what is normal or negotiable in their region or specialty.

Agencies negotiate every day. Most healthcare organizations negotiate only when a contract renews. This imbalance creates financial drift that compounds over time.

2. Contract Structures Often Favor Agencies, Not Health Systems

Many locum agreements include conditions that accelerate spend without improving quality or coverage. Common examples include:

- automatic rate escalators

- guaranteed minimum weekly hours

- emergency or surge multipliers

- weekend and call premiums that stack unpredictably

- insufficient performance requirements

- auto-renew clauses with no rate review

These terms shift risk away from agencies and onto the healthcare organization. When contracts are not reviewed regularly, rates rise quietly. Leaders often discover the impact months later when budget performance is analyzed.

Financial discipline requires more than contract ownership. It requires consistent monitoring of rate integrity over time.

3. Pricing Is Often Misaligned Across Specialties, Sites, and Vendors

Two physicians with similar backgrounds can cost significantly different amounts depending on:

- which vendor placed them

- which facility they cover

- which recruiter negotiated the rate

- how urgently the request was made

- how many layers of margin sit between provider and bill rate

This creates silent pricing drift across the enterprise. Leaders rarely see a consolidated view of rate consistency. As a result, organizations pay more than necessary simply because no one is comparing similar roles across similar conditions.

Rate misalignment is not a clinical issue. It is a financial visibility issue.

4. Vendor Incentives Do Not Align With Health System Goals

Agencies are paid more when organizations rely more on external labor. Their economic incentive is to increase billable hours, not reduce them. Even high-quality agencies operate within this structure.

When incentives are misaligned:

- external labor is used when internal coverage was possible

- agencies prioritize quick fill over right fit

- premium shifts are suggested before internal alternatives

- contract clauses encourage dependency rather than optimization

This is not malicious behavior. It is the natural outcome of an incentive system that rewards volume. Healthcare organizations regain control when they create a performance model that rewards vendors for efficiency, not reliance.

5. Internal Financial Blind Spots Make Overspend Hard to Detect

Most organizations lack a consolidated view of locum spend across departments, sites, and vendors. Finance sees totals. Operations sees coverage. Scheduling sees gaps. Each group has part of the picture, and no one sees the entire financial story.

This leads to:

- unnoticed rate creep

- slow recognition of overspend patterns

- inconsistent buy versus build decisions

- reliance on outdated assumptions

- missed opportunities to normalize rates

Overspend persists because it is difficult to identify the moment it begins. By the time budget variance becomes visible, the cost pattern is already established.

6. Operational Fixes Alone Cannot Solve a Financial Problem

Improving scheduling processes helps. Increasing internal capacity helps. Reducing drift helps.

However, none of these changes address:

- contract design

- price consistency

- vendor economics

- incentive alignment

- market benchmarking

- rate governance

Operations can reduce unnecessary reliance on locums. Finance determines what those locums cost. Overspend sits at the intersection of both. A financial problem requires a financial solution.

How Leaders Break the Overspend Cycle

Healthcare organizations that regain control of locums spend follow a consistent set of practices.

- They benchmark rates. This creates transparency and eliminates inflated pricing.

- They create competitive pressure across vendors. No single agency should determine rate norms.

- They normalize pricing across locations and specialties. This closes gaps created by inconsistent past negotiations.

- They integrate real-time spend visibility into workforce decisions. Scheduling choices are financial choices. Leaders need clear information at the moment decisions happen.

- They evaluate cost per outcome, not cost per hour. A lower rate does not always mean lower total cost. Productivity matters.

- They blend internal and external labor with intention. Locums become a strategic tool instead of a reactive default.

Organizations rarely eliminate locums. They eliminate unnecessary locums. That is what restores financial control.

The Bottom Line

Healthcare does not overspend on locums because of poor scheduling or inconsistent availability. It overspends because of pricing mechanics, incentive structures, and financial blind spots that accumulate quietly.

Once leaders understand the economics behind the problem, they can redesign how external labor is used and managed. This creates a more predictable cost structure and reduces reliance on premium labor.

A financial problem becomes solvable once it becomes visible.

Ready to bring more financial control and clarity to your locums strategy?

Request a Demo

Learn more about Kimedics

Kimedics is a provider utilization management platform. We help healthcare organizations gain visibility across internal and external staffing to reduce complexity and improve financial performance. For more information, book a demo or email kimedics@kimedics.com